Examining the current audio streaming landscape and future value drivers

New findings from the Edison Research’s Share of Ear study found that digital channels are capturing a growing share of attention in audio media. While traditional radio still reaches 98% of U.S. audience, time spent has decreased significantly as more than 30% of listeners now eschew AM/FM in favor of streaming services and satellite radio. This is especially true among younger audiences, as 42% of people aged 18–34 do not listen to AM/FM at all in a given day and their time spent with AM/FM fell by 40% compared to 2014.

The adoption of smartphones and connected devices has unbundled the three main types of audio content found on terrestrial radio into different services, with news and real-time information such as weather and road conditions being easily accessible via different apps, music consumption going to music streaming services, and talk radio being replaced by podcasts. Meanwhile, the rise of smart speakers, connected cars, and “hearable” devices like AirPods will continue to drive this unbundling of radio content and fuel the growth of audio streaming services, many of which still rely on advertising to monetize, unlike in video streaming where more and more content retreat behind ad-free subscriptions.

According to the latest data from IAB, digital audio advertising grew 31% to reach the $935 million in revenue in the first half of 2018, making it a key driver in digital advertising. While much ink has been spilled over speculating the future of video, the future landscape of audio media is equally worth attention as different forms of audio media shift from traditional distribution channels to online and thus open them up to disruption. Therefore, it is worthwhile to examine key categories of audio media, how they are evolving in the mobile age, and where they are going.

Music Streaming: Is Bundling the Future?

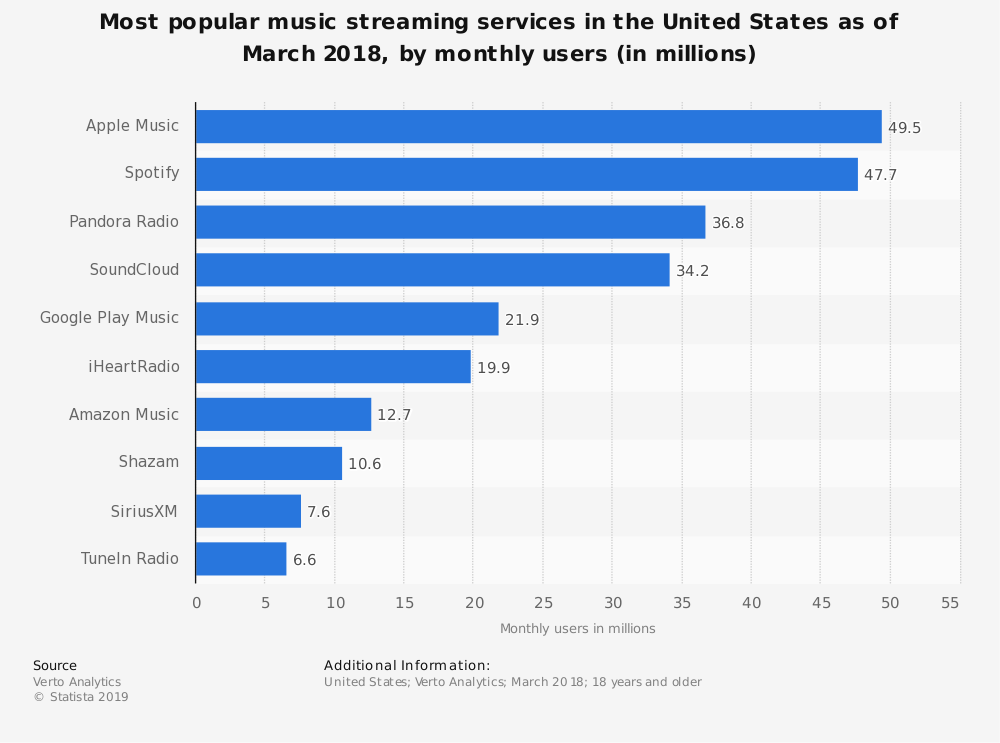

Radio DJs and record labels used to be the gatekeepers to what the masses heard, but the internet has upended the old distribution model and lowered barriers to entry in both production and distribution. Music streaming, which now accounts for over 75% of all music consumption in the U.S., appears to be a three-horse race between Spotify, Pandora and Apple Music at the moment.

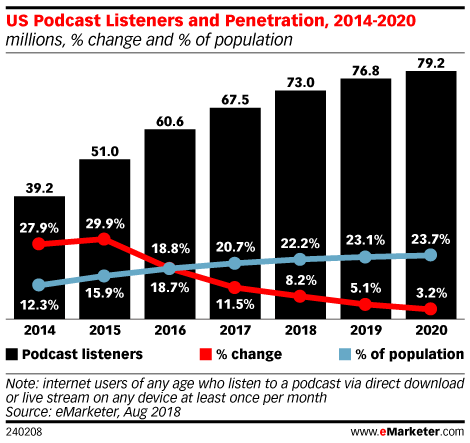

While Pandora and Spotify had an early start, Apple Music is catching up quickly by being the default option on 1.4 billion active Apple devices. According to a recent report from The Wall Street Journal, Apple Music now has more paid users in the U.S. than Spotify”Š—”Šspecifically, over 28 million versus Spotify’s 26 million as of February 2019. Spotify, which most recently reported 217 million MAUs worldwide (100 million of which are paid subscribers), remains the global leader in music streaming, although Apple Music is fast expanding internationally as well. In contrast, Pandora currently has roughly 7 million paid subscribers, as over 90% of its 75 million monthly active listeners are using the ad-supported tier. It seemed to lose some of its early-mover advantage because it waited too long to launch an on-demand listening subscription service that is competitive with Spotify and Apple Music, but its sale to satellite radio company Sirius XM, which itself has over 36 million subscribers in North America, could spell new growth opportunities, especially among in-car listeners. The main difference between Pandora and Spotify vs. Apple Music lies in their different business model. Spotify and Pandora has a two-tiered freenium structure that supports both ad-supported free access (with severely limited functions on mobile) and paid subscriptions, whereas Apple Music is subscription-only, as the service exists as a piece of a larger puzzle that is Apple’s ecosystem. Spotify and Pandora used to have an advantage in terms of being platform-agnostic but Apple Music has been rolled out to rival platforms such as Android phones, Amazon Echo, and Fire TV devices, and is reportedly coming to Google Home speakers soon. With universal accessibility now being table stakes, music streaming services are looking to new ways to propel user growth. Apple Music has a partnership with Verizon, making it free for subscribers to the carrier’s unlimited data plan. Spotify, on the other hand, has teamed up with Hulu for a 2-for-1 bundle deal for all eligible U.S. subscribers. With Apple doubling down on services, there is a high chance Apple Music could become part of Apple’s media subscription bundle that also includes news and video content. This trend towards bundling also points to an interesting characteristic of the music streaming business. In contrast to video content, which is still highly differentiated, music has become largely commoditized. In other words, content itself is not a differentiation point for music streaming services. All streaming services have roughly the same catalog of content, as the three record labels that control the majority of music rights are essentially signing the same licensing deals with every streaming service. Most music artists today make the majority of their income from touring and merchandise, and not from album sales or streaming, therefore they need their work to reach an audience as wide as possible. Even superstars like Beyoncé or Taylor Swift, whose substantial fanbases enable them to temporarily withhold their new music from certain services, eventually have to make their works available on streaming, in order to maintain demand for more lucrative pursuits. As the battle between Apple Music and Spotify continues to escalate, other players in music streaming like Amazon, Google, and Tidal are also fighting to get a bigger piece of the pie. They mostly likely won’t be able to catch up to the scale of the three leading services, but they can still amass a sizeable user base of casual listeners and monetize through ads or extract value via ecosystem lock-in. Take Google and Amazon for example. Both platform owners are trying to leverage their lead in the smart speaker market to promote their music streaming services and open new revenue streams. Users of Google Home and other Google Assistant-powered speakers now get a free ad-supported version of YouTube Music while Amazon also quietly added a free ad-supported tier to Prime Music to allow Alexa users without Prime subscriptions to listen to a limited selection of music. Both services are designed to capture users with no existing music subscriptions with a free service with the hope of upselling them on the paid service one day. Even if they don’t convert, they would be taking some ad impressions away from Spotify and Pandora, both of which lack the perks of native platform support that these two plus Apple Music enjoy. This also explains why Spotify struck a partnership with Samsung to get its app pre-installed on all new Samsung smartphones as the go-to choice of music streaming. There is definitely a benefit for a streaming service to be the platform default in acquiring new users, even though integration with other music streaming services are still supported by most platforms. Even Apple is set to open up Siri to support music playback control for streaming services other than Apple Music later this fall. For marketers, this means that with the exception of Apple Music, all the music streaming services will support ads and are open to other forms of brand integrations, such as sponsored playlists and homepage takeovers. In addition, as music consumption shifts towards an all-access streaming model, there is also a real opportunity for curation and recommendation to help listeners discover new music they may enjoy. In lieu of a physical music collection, now our playlists reflect part of our identities. No wonder Spotify and Pandora already position their algorithmic recommendations a key value offer, and brands such as men’s fashion startup Eison Triple Thread and Tinder tapping into listener data for personalized targeting. Podcasting is having a good year so far. The 2019 Infinite Dial Study found over 50% of the U.S. population ages 12 and older have now listened to at least one podcast. According to eMarketer’s latest forecast, 73 million US consumers, or 22.2% of the population, will listen to a podcast at least once per month in 2018. In 2014, that penetration rate was 12.3%, which serves as an indicator of how quickly podcasts have managed to permeate the media landscape in the past few years.

Unlike music, where the record labels own most of the content and sign licensing deals with distribution channels, podcasting has an open, decentralized structure rooted in its bootstrapping origin. Podcast creators own their content and manage their own distribution, resulting in a more fragmented landscape where platform owners and niche players co-exist and compete for attention. Spotify, Google, and Pandora all recently joined the podcasting arena, but Apple still commands the majority of podcast listening with its native Podcasts app on iOS devices. Fueled by a growing audience that skews younger, more educated, and more affluent than average, podcasts are also starting to attract more advertisers, typically DTC brands looking to use the direct-response measurability of podcast ads to their advantages. However, due to a combination of lack of mass reach and a centralized, standardized ad network, it has yet to break out as a must-have advertising channel for most Fortune 500 advertisers. This niche-to-mass media bottleneck is a hurdle that the podcasting industry must overcome in order to keep growing. Fortunately, recent developments in the podcasting space are showing some optimistic signs. In a bid to diversify its content and differentiate its core service from rivals, Spotify has been ramping up its investment in the podcasting space. With its recent acquisitions of podcast production startups Gimlet Media and Parcast, Spotify is set to produce its own exclusive podcasts, which they will be able to monetize fully without worrying about licensing fees. If this truly takes off, it could allow Spotify to monetize its own content like a true aggregator would, as this allows Spotify to vertically integrate into content development, as opposed to licensing music content from the record labels. Spotify also bought Anchor, a startup that creates tools to help podcasters make and distribute podcasts, with a nascent advertising service for monetization. By acquiring Anchor, Spotify now has a way to capture new podcasters, which they can then either groom into Spotify exclusives or monetize their content via its robust advertising operation. Spotify is in a unique position to become the leading podcast ad platform, despite the inherently open and decentralized structure of the medium. Thanks to its existing music streaming business, Spotify’s ad business is already operating at a scale larger than any podcast ad provider, and buying Anchor gave it access to the data of the second largest podcast player in the market. Still, the question remains, can Spotify convince its over 200 million users worldwide to give podcasts a try? Perhaps if Spotify manages to have an original hit as phenomenal as the first season of Serial, it may even drive some existing podcast listeners using other podcast apps to make the switch. The vast majority of podcasts today monetize their content with advertising, typically native host-read ads, although some do pursue alternative forms of monetization, such as creating extended, ad-free versions available for paying subscribers or soliciting listener-funded donations. Niche producers like The Athletic has also been producing ad-free shows exclusively for subscribers. However, this week saw the launch of a new business model in Luminary, a VC-backed podcasting startup with the explicit goal to explore if an ad-free subscription model would work for podcasts at scale. With a slate of over 40 ad-free original shows from celebrities like Daily Show host Trevor Noah, actress Lena Dunham, as well as some established podcast personalities, Luminary will charge listeners $7.99 a month to access its exclusive programming. However, due to the open nature of the larger podcast ecosystem, users can also use its app for free to listen to other podcast programs as well. Well, mostly. Some of America’s most popular podcasts like The Daily from The New York Times, The Joe Rogan Experience, as well as shows produced by Spotify-owned Gimlet Media, Parcast, and Anchor’s network of smaller creators won’t be available in Luminary, as these creators have opted-out, in order to maintain their own direct relationship with consumers. While these exceptions may be small compared to the totality of podcasts that are accessible via Luminary, they do contain some of the industry’s biggest shows, such as The Daily by the NYT and Reply All. This incompleteness, coupled with the fact that most podcast listeners aren’t used to paying for content, may severely hinder adoption and undermine Luminary’s growth. Regardless of how Luminary turns out, however, the fact that a company devoted to premium podcasts now exists shows how far podcasts have come. Then there is Apple, whose native Podcasts app commands about 80% of podcast consumption, but has yet to do anything substantial to build out a platform and help podcast creators monetize. However, earlier this month, Apple released a revamped iTunes web interface for podcasts out of the blue. Previously, the webpages would link back to iTunes and featured little information for each podcast. Now the interface is more user-friendly for casual listeners, who are more likely to listen on a web interface than in a dedicated app. Given that Apple is also planning to bring a dedicated Podcasts app to the Mac with the next major version of macOS, the Cupertino company may finally start to get serious about the podcast experience it offers as it doubles down on services. It is not entirely impossible that we may even get a paid podcast subscription a la Luminary from Apple soon. As previously mentioned, the rise of smart speakers, connected cars, and “hearable” devices are three key future drivers of audio consumption. Asking voice assistants to play music is consistently ranked among the top requests that smart speaker users make, and voice-based conversational interface will play a big role in the future of audio content discovery and listener behavior. In-car listening, for example, remains a strong hold for terrestrial radio. But, as connected cars and mobile streaming become commonplace, a lot of radio listeners are switching from options built into the dashboard to streaming audio content, be it music or podcasts, on their phone, either through mobile solutions like CarPlay and Android Auto or simply via Bluetooth. Similarly, the adoption of smart speakers significantly removes friction for people to access audio content, thus boosting at-home consumption. The future of audio advertising will become far more integrated and native in order to keep up with the changing listener behavior. Imagine a Spotify ad break narrated by Google Assistant with some pieces of helpful information, or an ad break during your own carpool karaoke session presented by Alexa via Echo Auto. Of course, none of the digital assistants is being monetized through ads today, and some of them (Siri) likely never will. And when autonomous cars become reality, audio will likely lose out to video or other immersive formats as the go-to media for in-car entertainment. That being said, these developments are all much further into the future, and it is too early to tell exactly how they will impact audio media. Another big value driver for audio content will be the adoption of voice-based wearable devices, aka the “hearables.” Right now, wireless earbuds are having a moment. Apple’s long-anticipated update to AirPods, a true sleeper hit, was finally released last month. Barely a month later, reports say that both Amazon and Microsoft might soon bring their own wireless earbuds to the market. Even Beats, an Apple subsidiary, also released their own take on wireless earbuds. Part of why everyone is suddenly all jumping on the wireless earbud bandwagon is because of the level of cultural relevance that the AirPods has achieved is opening up the market for more products like it. Another big part is that these products are preparing consumers for the future of audio-activated wearable devices (like the hands-free “Hey Siri’ function on the new AirPods) that augment our reality with audio cues. It presents a true path for voice assistants to jump off the smart speakers and mobile devices, and just be with the users wherever they are to provide useful, contextually aware information, thus further broadening the definition of what we consider to be audio content.Podcasts: Will Subscriptions Work?

Future Value Drivers